US Treasury, Federal Reserve Publish UIGEA Rules

In a highly controversial move pushed through in the waning days of the Bush administration, officials at the US Treasury and the Federal Reserve today formally published rules and procedures as called for by the 2006 Unlawful Internet Gambling Enforcement Act (UIGEA).

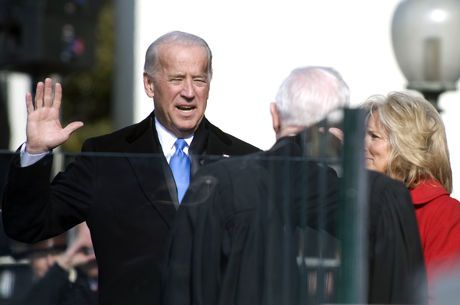

The regulations, set to go into effect on Jan. 19, 2009, one day before President-elect Barack Obama will take the oath of office, call in general for a "due diligence" approach in blocking the flow of funds from would-be gamblers to online sites. Poker, as expected, was not granted any form of exemption under the rules, despite the urgings of a few dozen poker players as the rules were being drafted. Banks, payment processors and other affected institutions are expected to comply with the measure by December 1, 2009.

The dense, 66-page document consists of exacting language that is open to multiple interpretations, as evidenced by the first 50 pages being explanatory definitions before the publishing of the rule itself. One example is a parsing of the difference between games "subject to chance" and "predominantly subject to chance," as part of the argument put forth by Treasury as to why poker and other skill games are, in the eyes of the government, expected to be covered by the law. Previously noted exemptions for horseracing and fantasy-sports leagues remained intact.

While the body of the rule's publication is still being worked through by industry experts, a few points were clear at first read. Among those signature points:

? Blocking of transactions under the UIGEA will be attempted in one direction only, that of prospective players to online sites. Payments �C such as cashing out from a site �C back to customers will not be blocked. The differentiation is an effort to choke off the profitability for sites who attempt to take in player funds.

? "Unlawful Internet gambling" remains undefined under the statute as published; instead, the law defers to the existing morass of state and other laws defining gambling. Of perhaps greater importance is that by doing so, the rule attempts to transform Internet-based gambling into a "states rights" issue, in a manner similar to the ongoing attempt by the Commonwealth of Kentucky to seize Internet domains it believes competes with its signature horseracing industry. As defined in the published rules: "The Agencies believe that the Act's restrictions apply only to transactions that are unlawful under applicable U.S. Federal or State law. The Act's definition of 'unlawful Internet gambling' clearly states that it refers to a bet or wager that 'is unlawful under any applicable Federal or State law in the State or Tribal land in which the bet or wager is initiated, received, or otherwise made.'"

? The published rules significantly revised upward the financial estimates for implementing the rules, despite rewriting some portions of the rules in a way to eliminate many smaller banking and payment-processing entities. Costs for initial implementation now are estimated at a million man-hours and $88 million, with maintenance quickly jumping that total over $100 million.

? Payment-processing services such as Western Union will receive an exemption for payments made from their physical offices; the rules as published instead vall for the blocking of payments made over the Internet through such services.

Calls from officials such as Rep. Barney Frank (D-MA) to avoid formalizing the UIGEA regulations were summarily ignored with the publication. In fact, one passage in the rules openly defied the claims made by Frank and others that the rules as published place too much pressure and unfunded responsibility on an already stressed financial system, by stating, in effect, that savings to credit-card companies on gambling-related chargebacks more than offsets the expense. "This funds flow interdiction," according to the explanation, "is designed not only to inhibit the accumulation of consumer debt but also to reduce debt collection problems for insured depository institutions and the consumer credit industry. Treasury believes that the reduction of debt collection problems through the final rule's funds flow interdiction process will yield important benefits for insured depository institutions and consumers given the recent turmoil in the financial markets that is causing liquidity problems for insured depository institutions and constraining the availability of consumer credit." The Treasury also cited "other benefits," declaring that "the final rule could restrict excesses related to unlawful Internet gambling by underage or compulsive gamblers."

Reaction to the rules' publication was widespread, with hundreds of news outlets picking up the story in the first couple of hours following the document's appearance on the US Treasury site. US Rep. Shelley Berkley (D-NV), an outspoken critic of the UIGEA since its inception, was quoted by the Las Vegas Sun as follows: "These rules place an unfair burden on banks and other businesses that will now be forced to play the role of law enforcement. Instead of making the situation better, these regulations will only create chaos, huge headaches and high costs for all those involved. I am appalled that at a time when our nation faces the worst economic crisis we have seen in 70 years, President Bush remains obsessed with a regulation that will only harm the financial services sector."

The Washington, DC-based Poker Player's Alliance also issued a statement condemning the rules' finalization, but gave no indication as to future plans. According to PPA Chairman Alfonse D'Amato, "The PPA remains optimistic that the new Administration and the new Congress will recognize the failures of UIGEA and will act swiftly in the New Year to overturn this flawed policy."